There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

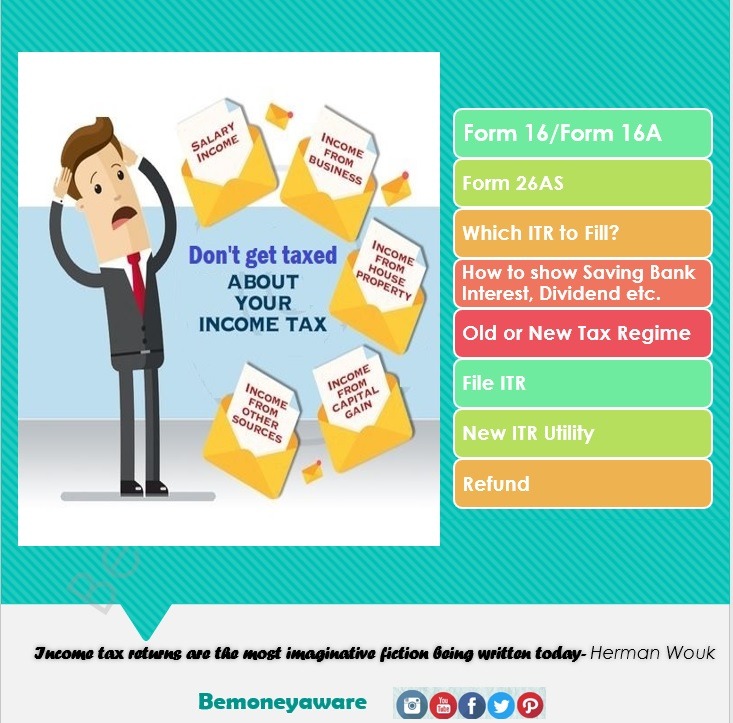

Don't get Taxed by Income Tax

Language: English

Instructors: Bemoneyaware

Why this course?

"Income tax returns are the most imaginative fiction being written today." Herman Wouk:

Have you ever wondered what income tax is all about? What are the various forms? What's the difference between a TDS and a TCS? Do you know how to calculate your income tax?

If you're looking for answers, then we have just the course for you.

Our Income Tax course will teach you everything you need to know about income tax in simple terms that are easy to understand. Plus, there are no high-level jargon within the course. You'll be able to learn through our lectures and quizzes.

This course is suitable for professionals, and business owners who want to learn about Income Tax.

To understand Income Tax we need to understand the following

After successful purchase, this item would be added to your courses.You can access your courses in the following ways :